carried interest tax rate 2021

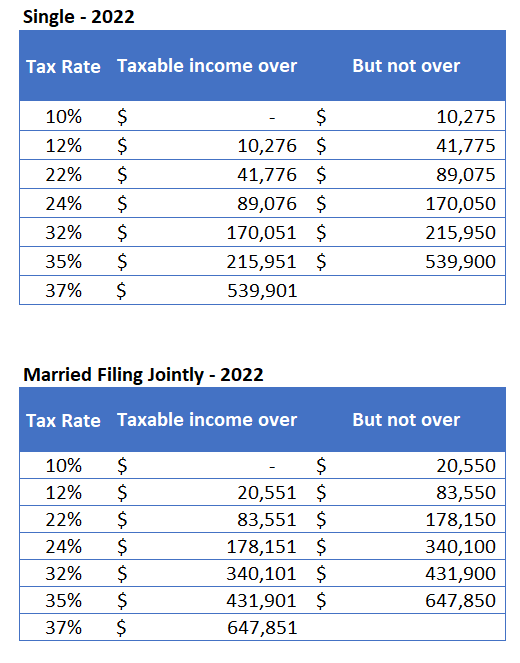

Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be eligible for preferential long-term capital gain LTCG rates instead of higher ordinary income tax rates. Carried interest is the portion of an investment funds returns eligible for a capital gains tax rate of 15 or 20 instead of the ordinary income tax rate of up to 37.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Carried Interest Fairness Act of 2021.

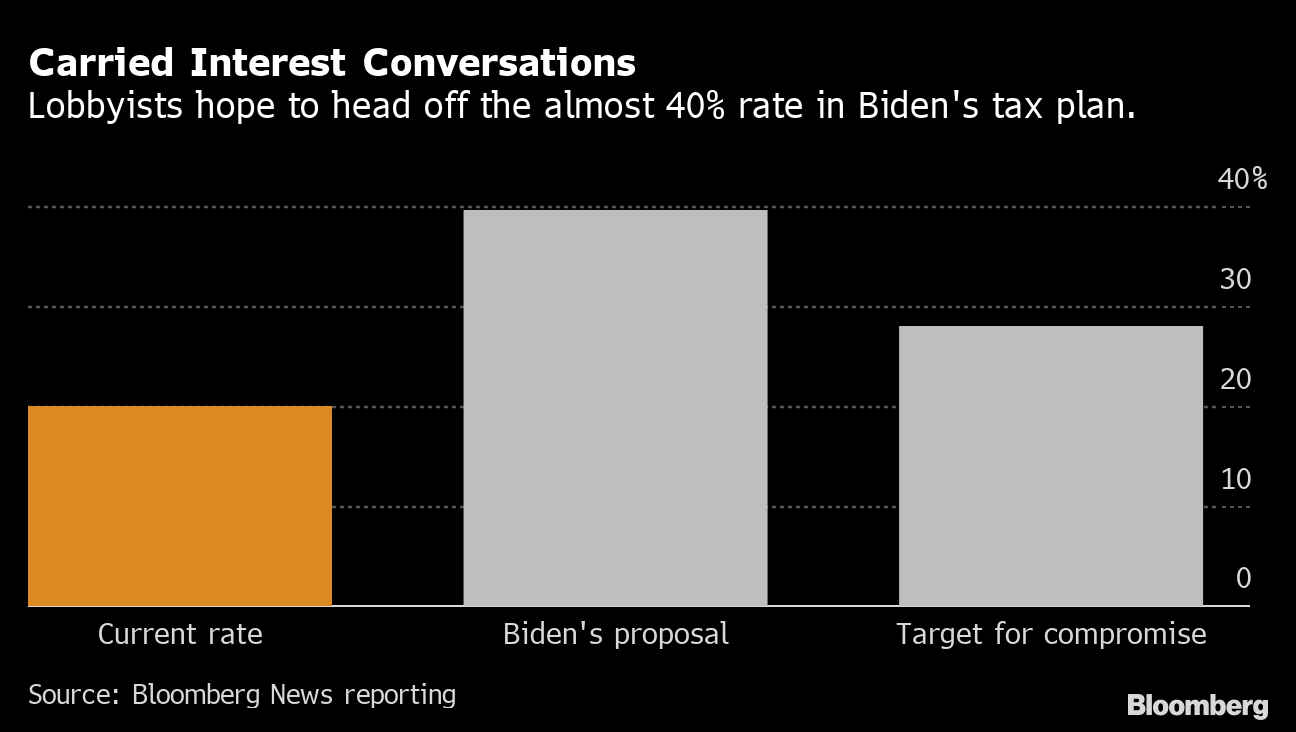

. Ad Compare Your 2022 Tax Bracket vs. The IRS released final regulations TD. Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021 202 PM.

Department of Treasury and the Internal Revenue Service released final regulations the Final Regulations under Section 1061 of the Internal Revenue Code of. House Democrats want to restrict the use of a prized private-equity tax break to help fund President Joe Bidens economic agenda but their. A key exemption from these rules is the carried interest exemption which if met means that amounts should be subject to capital gains tax at a lower rate of 28.

On July 31 2020 the Department of Treasury. Your 2021 Tax Bracket to See Whats Been Adjusted. Dubbed the Carried Interest Fairness Act of 2021 or HR 1068 the bill would allow fund managers who put their own money in a funda common practice in private equityto.

Tax incentives include 0 tax rate for carried interest. Carried interest is often only paid if the fund achieves a minimum return known as the hurdle rate. This bill modifies the tax treatment of carried interest which is compensation that is typically received by a partner of a private equity.

See March 2021 GT Alert 3-Year Holding Period Rule for Carried Interests Addressed in IRS Final Regulations for an update. However carried interest is often treated as long-term capital gains for tax purposes subject to a top tax rate of 238 20 on net capital gains plus the 38 net. Proceeds from that individuals partnership interest are often taxed as capital gain rather than ordinary income.

The final regulations generally retain the. Susan Minasian Grais CPA JD LLM. According to a news release from Pascrell Levin and Porter the Carried Interest Fairness Act of 2021 would tax certain carried interest income at ordinary income tax rates.

A reduced tax rate. On January 13 2021 the IRS posted final Treasury Regulations for Section 1061 of the Internal Revenue Code. In general equity issued in exchange for services is taxable at ordinary income rates unless that equity is a profits interest.

News June 30 2021 at 0208 PM Share Print. Carried interest typically. September 13 2021 821 AM PDT.

Bidens already calling for a long-term capital gains tax rate hike that would cause rates to skyrocket to 396 higher than the current top ordinary income tax rate. 7 2021 providing guidance on the carried interest rules under Section 1061. Every president since George W.

The law known as the Tax Cuts and Jobs Act PL. 18 and 28 tax rates for individuals for residential property and carried interest 20 for trustees or for personal representatives of someone who has died not including. This item discusses proposed regulations that the IRS issued on July 31 2020 regarding the tax treatment of carried.

In January 2021 the US. Bush has vowed to eliminate the tax break that allows compensation to be taxed at the lower capital-gains rate yet carried interest continues. This 20 percent long-term capital gain rate is lower than the marginal tax rate applied to most families in 2021 single filers would pay a marginal tax rate of 22 percent of.

The Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 passed its. Discover Helpful Information and Resources on Taxes From AARP. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax rate on income received as compensation rather.

Section 1061 increases the holding period required for long-term. The Biden administrations proposal to tax carried interest at a higher rate.

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Banks Will Be Closed On These Dates This Week In These States Get Full Bank Holiday List In October Holiday List Growing Wealth October

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How To Avail Income Tax Benefits And Avoid Tds On Fixed Deposits Income Tax Personal Loans Income Tax Return

Banking Financial Awareness 20th December 2019 Awareness Financial Banking

Subordinated Debt Meaning Example Risk And More In 2021 Economics Lessons Accounting And Finance Financial Management

Gst Billing Software With Full Source Code In 2022 Billing Software Coding Web Design

Sec 199a And Subchapter M Rics Vs Reits

Bank Holidays June 2021 Check If There Is Bank Holiday In June In Your City Holiday Read Holidays In June Tech Job

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Banking Financial Awareness 20th December 2019 Awareness Financial Banking

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

House Rent Allowance Exemption Tax Deductions Tax Deductions Being A Landlord Income Tax Return

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg